A Guide to Obtaining Your Tax Residency Certificate UAE

Introduction

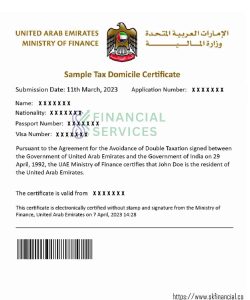

Navigating the intricate landscape of tax regulations in the United Arab Emirates (UAE) is a crucial aspect of international business operations. One powerful tool in the arsenal of businesses and individuals seeking to mitigate the challenges of double taxation is the Tax Residency Certificate (TRC). A comprehensive guide presented by SK Financial Services, will walk you through the process of obtaining a Tax Residency Certificate in the UAE, with a focus on two key aspects about Tax Residency Certificate (TRC) itself and Certificates of Commercial Activities (CCA).

Table of Content:

1. Tax Residency Certificate (TRC) in UAE

In the dynamic landscape of the United Arab Emirates (UAE), where economic opportunities thrive, understanding the intricacies of taxation becomes paramount. One crucial aspect is obtaining a Tax Residency Certificate (TRC), a document that plays a pivotal role in mitigating double taxation challenges and fostering international trade relations.

Why is a Tax Residency Certificate Essential?

UAE’s strategic position in global trade has led to an influx of businesses and individuals. However, to navigate the tax system effectively and avoid double taxation, a TRC becomes a valuable tool. This certificate allows qualifying entities and individuals to leverage the double taxation treaties signed by the UAE, offering relief from the burden of being taxed on the same income in multiple jurisdictions.

Key Eligibility Criteria for TRC:

For Natural Persons:

- Residency in the UAE for a minimum of 180 days.

- Submission of an annual lease agreement officially documented by competent authorities.

For Legal Persons:

- Establishment for at least one year.

- Submission of audited financial accounts covering the relevant year.

Note: Offshore companies are ineligible for TRCs; they qualify for a tax exemption certificate.

2. Certificates of Commercial Activities (CCA)

Additionally the TRC, businesses in the UAE can benefit from Certificates of Commercial Activities (CCA). These certificates, issued by the Federal Tax Authority (FTA), support the recovery of Value Added Tax (VAT) incurred by a registrant in a different country, regardless of the existence of a double tax avoidance agreement.

Applying for Certificates of Commercial Activities:

To apply for a CCA, the applicant must be VAT registered and possess an active Tax Registration Number (TRN). Following documents are typically required:

- The Copy of the trade license.

- Copies of passports and Emirates IDs of owners/partners/directors.

- Requesting letter issued by the company, signed and stamped by the authorized signatory.

How to Obtain Your TRC: A Step-by-Step Guide

First Step: Determine Tax Residency

- For Natural Persons:

- Consider usual place of residence and financial interests.

- For Legal Persons:

- Check if the entity was established, organized, or acknowledged by state law.

Second Step: Gather Required Documents

- Companies:

- The Certificate of incorporation.

- Corporate organizational structure.

- Passport copies and UAE residency visas of directors/shareholders/managers.

- Audited financial statements or bank statements for the last six months.

- Individuals:

- Passport, UAE Residence Visa, and Emirates ID.

- Residential lease agreement or tenancy contract.

- Latest salary certificate.

- Verified bank statements for the previous six months.

Third Step: Online Application Process

- Login or sign up for a Tax Certificate account on the FTA Portal.

- Fill out the application form and upload the required documents.

- Pay the application fee.

Forth Step: Certificate Issuance

- Pre-approval takes 4-5 days.

- TRC is issued within 5-7 working days upon approval.

The Taxation Residency Certificate (TRC) User Guide

Download a detail user guide on how to get Tax Residency Certificate (TRC) UAE and Certificates of Commercial Activities (CCA)

Frequently Asked Questions (FAQs)

A1: TRC in Dubai is valid for one year from the date of issue.

A2: Fees vary based on the stage of the application.

A3: No, offshore companies are not eligible. They qualify for a tax exemption certificate.

SK Financial Services: Your Partner in Tax Compliance

At SK Financial Services, we understand the nuances of the UAE tax system. Our expert guidance ensures a seamless process for obtaining your Tax Residency Certificate or Certificates of Commercial Activities. For personalized assistance, contact us or visit SK Financial Services for more information.

Disclaimer: The details provided in this blog is for informational purposes only and should not be considered as professional advice. Please consult with our qualified tax advisors for specific guidance tailored to your situation.

Feel Free to Contact Us

Mobile: +971 54 3304320

Email: Syed.faisal@sk.financial

Whatsapp: +971 54 3304320

Timing: 9:00am to 5:00pm

Days: Monday to Saturday

Latest Posts

Share this:

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Reddit (Opens in new window) Reddit

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on WhatsApp (Opens in new window) WhatsApp

- More